Proponents of hard money – such as gold or Bitcoin – are constantly trying to draw attention to the problems of unbacked paper money. A good way of doing this is to highlight the various developments that have taken place since 1971 – the end of the last gold standard.

On August 15, 1971, the then US President Richard Nixon “temporarily” suspended the convertibility of the US dollar into gold – the suspension of convertibility continues to this day. The saying “nothing is as permanent as temporary government intervention” is no coincidence.

Before the Nixon shock, foreign central banks were still able to exchange their US dollars for gold at a fixed exchange rate (35 US dollars per troy ounce). As the countries participating in the so-called Bretton Woods system pegged their currencies to the US dollar at a fixed exchange rate, the gold standard effectively ended in 1971 for other countries such as Indonesia.

The reason for the abolition of the gold standard was excessive US government spending to finance the costly Vietnam War (1955-1975), among other things. As a result, foreign countries began to doubt the gold backing of the US dollar and increasingly wanted to exchange their US dollar reserves for gold. This was not without reason, as the ratio of gold to US central bank money had already continued to decline in the preceding years. Although everything was far from perfect before 1971, the abolition of the convertibility of the US dollar into gold ultimately removed a disciplining force for good – which was to make things worse.

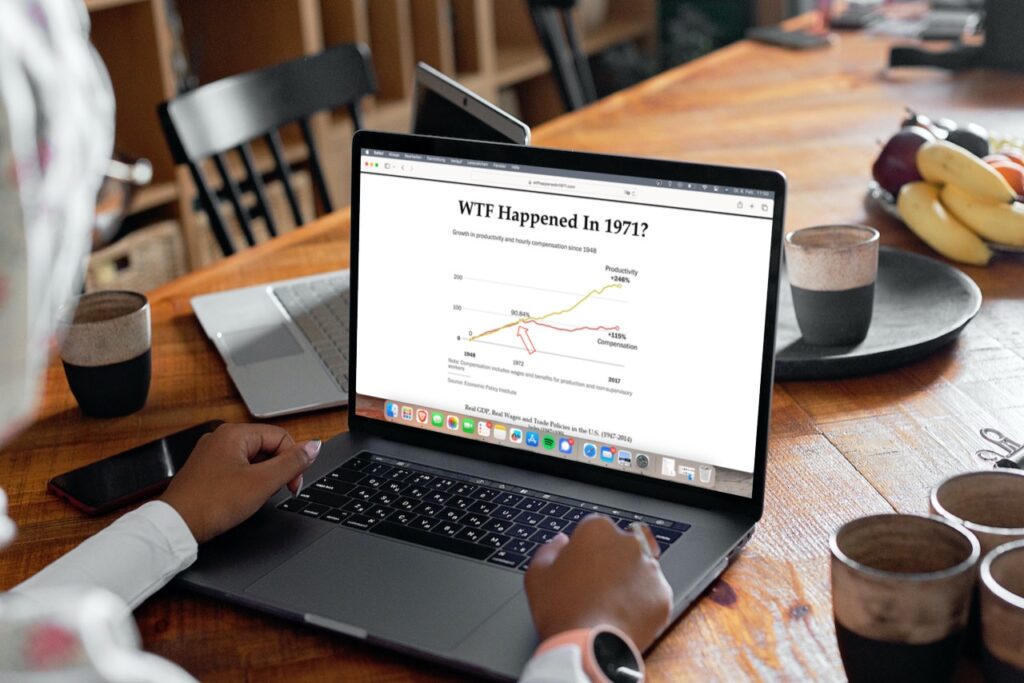

WTF happened in 1971?

The website wtfhappenedin1971.com is more than just a repository of economic charts; it’s a portal to understanding how the world fundamentally changed when it embraced fiat money (e.g. the US dollar and the Indonesian Rupiah). As we navigate through the complexities of modern financial systems, the lessons from 1971 are crucial for informing our decisions and perspectives on monetary policy and economic health. The shift to fiat money has had profound and far-reaching effects on society, from inflating asset prices to widening the gap between the rich and the poor. But take a look by yourself and gain a deeper appreciation for the intricacies of our financial system and the importance of sound money principles.

Visit the Website here: wtfhappenedin1971.com

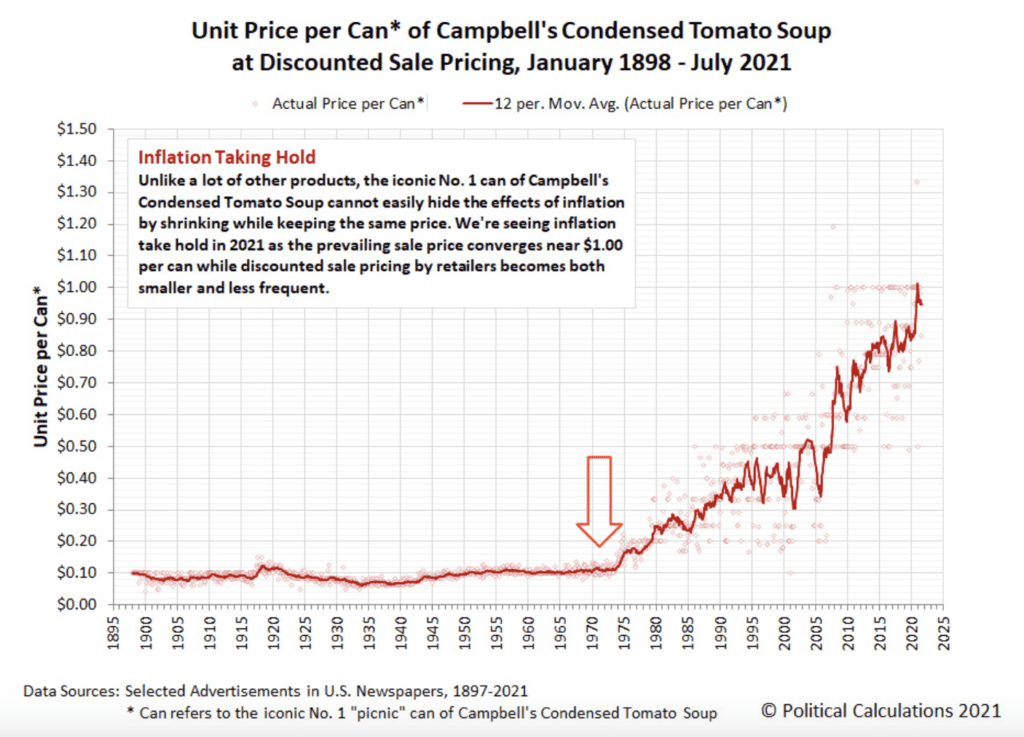

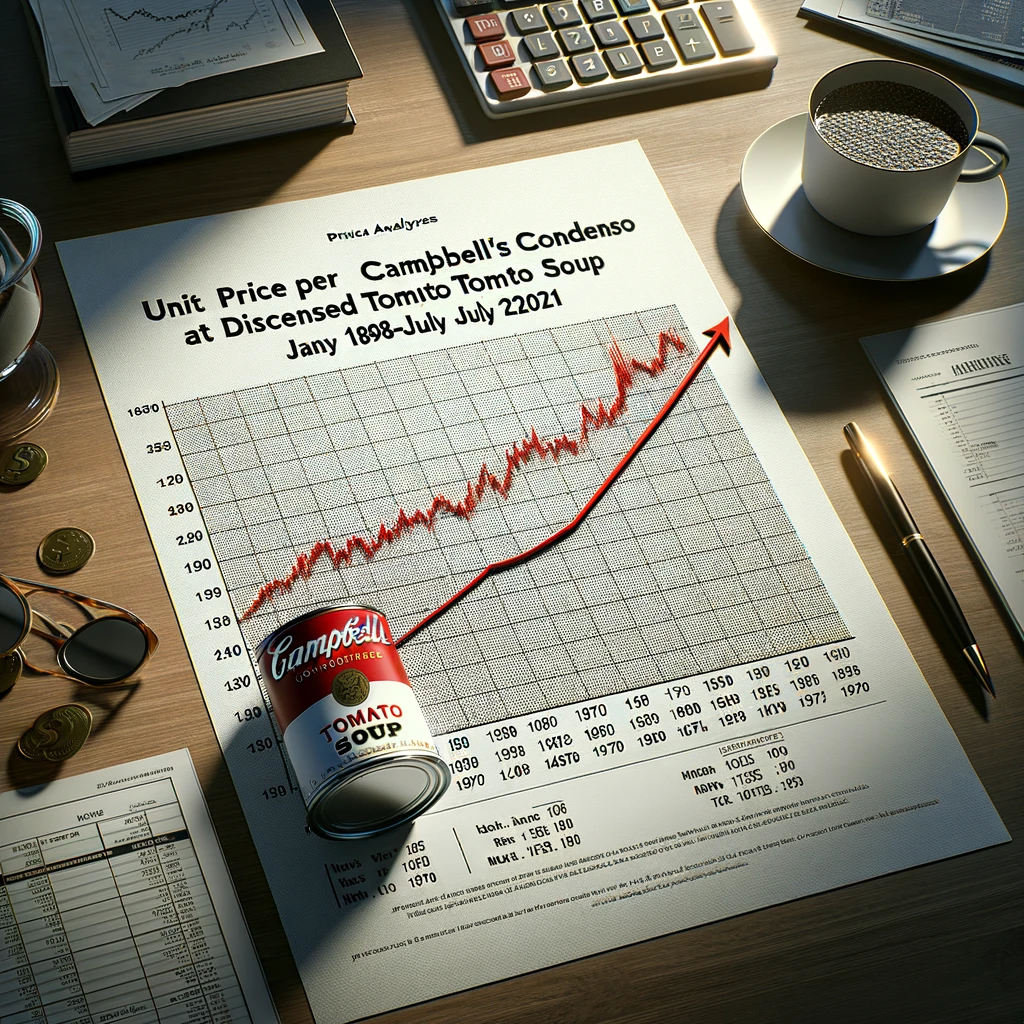

Example: Price increase of Campbell’s Condensed Tomato Soup

So let us take a simple Example. A can of Tomato Soup. The question we want to answer is: How did the price of the same product changed before 1971, after and until today. Why do we choose this can? Because unlike a lot of other products, the iconic No. 1 can of Campbell’s Condensed Tomato Soup cannot easily hide the effects of inflation by shrinking while keeping the same price.

This is a Can of “Condensed Tomato Soup” from the American company “Campbell Soup Company” which was founded 1869. Their Tomato Soup in a can is well known and used in American households.

A can of “Condensed Tomato Soup” from the American company “Campbell Soup Company”

Since 1897 the prices of such a can was collected until today. And the results are astonishing. But look for yourself:

Graph: showing the price increase due to money printing of the Campbells tomato soup can

While the price was until around 1971 pretty much the same it increased drastically after 1971. Rising drastically from around constant 10 cents in the more than 60 years before 1971 till around 1 Dollar in just 50 years after 1971. A 10 times increase. But did your salary also Increase by 10 in that time?

Take your time and find out more interesting facts on the Website wtfhappenedin1971.com

A student looking at the website www.wtfhappenedin1971 on his MacBook

One Comment