All beginnings are difficult. However, venturing into the complex world of Bitcoin and other cryptocurrencies can be especially challenging. Despite the abundance of well-prepared information available today, the overwhelming amount of it can be daunting for complete beginners. In this beginner’s guide, we aim to simplify the process for you by providing all the necessary information to enter the world of Bitcoin & Co. In ten short sections, you will be equipped with the knowledge needed to get started.

Table of contents:

1. What is Bitcoin?

2. What problem does Bitcoin solve?

3. What are the criticisms & dangers?

4. Should I buy Bitcoin?

5. Where and how can I buy Bitcoin?

6. What other cryptocurrencies are there?

7. Should I also buy other cryptocurrencies?

8. How do I store Bitcoin safely?

9. Do I have to pay tax on Bitcoin?

10. What else should I know?

1. What is Bitcoin?

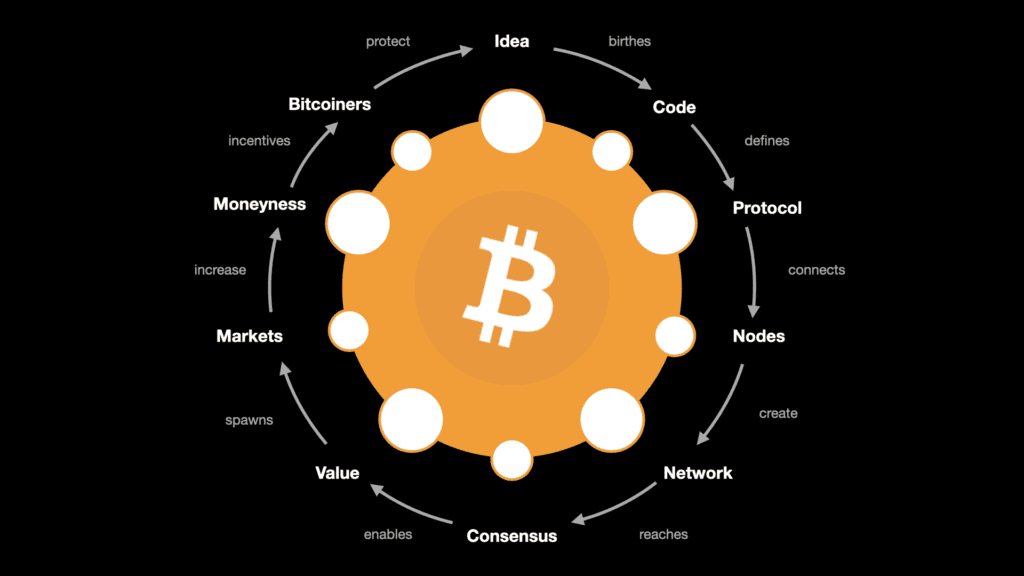

Bitcoin is often described as the first digital currency or the first cryptocurrency. However, this isn’t entirely accurate, as the concept of cryptocurrencies dates back to the 1990s. Unfortunately, those early cryptocurrencies faced various issues that compromised their security and usability. Satoshi Nakamoto, the inventor of Bitcoin, addressed these problems in 2008, creating the world’s first secure and finite digital asset. Many view Bitcoin as a revolutionary technology that adds a new asset class to the existing ones and has the potential to transform the current monetary system.

2. What problem does Bitcoin solve?

Despite frequent associations with criminal activity and its depiction as “magic internet money” in both mainstream and social media, these characterizations fail to capture the essence of Satoshi Nakamoto’s ingenious invention. Bitcoin wasn’t created to replace PayPal, Visa, or Mastercard with a faster, more anonymous system. Instead, it offers a secure, free, non-manipulable, and uncensorable alternative to the world’s current monetary systems, providing infrastructure for a secure, global monetary network. This is crucial in a world where approximately 38% of adults lack access to banking or financial services, often due to their social status. Bitcoin presents a solution to these issues by being globally accessible and requiring no permission to use. Furthermore, it addresses the problems of manipulable monetary systems and censored money transfers, offering an immutable supply capped at just under 21 million BTC, thus solving the issue of digital scarcity.

3. What criticism & dangers are there?

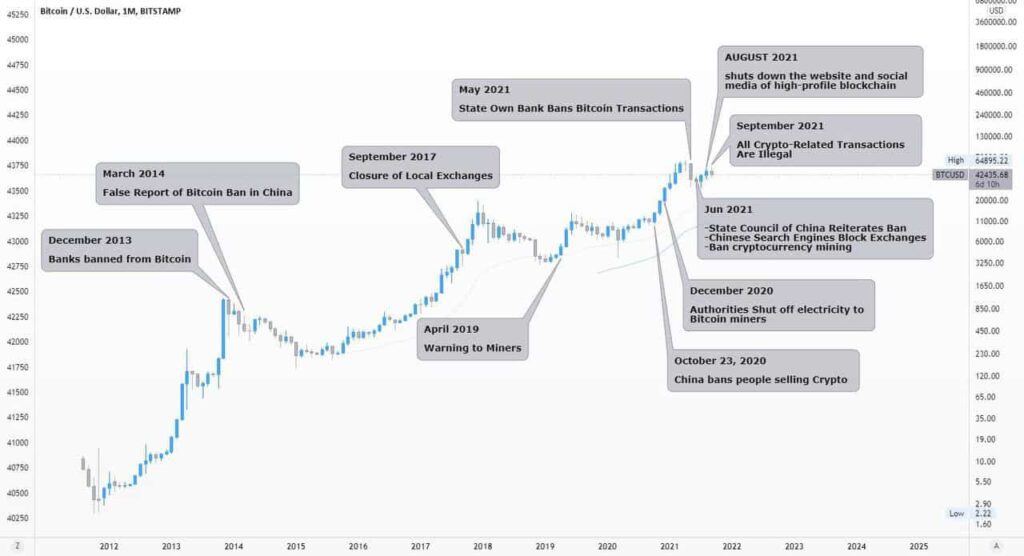

Criticism of Bitcoin varies widely, including concerns about government bans, criminal use, lack of intrinsic value, energy consumption, threats from quantum computing, and doubts about the viability of a deflationary currency. However, these criticisms often overlook the broader context or misunderstand Bitcoin’s underlying principles. For instance, the decentralized nature of Bitcoin makes it difficult for governments to ban, its use by criminals has decreased over time, and concerns about energy consumption neglect the security benefits and the increasing use of renewable energy sources.

4. Should I buy Bitcoin?

“It’s riskier not to own any Bitcoin than to own a small part.” This sentiment, commonly shared within the Bitcoin community, highlights the potential risks and rewards of investing in Bitcoin. Contrary to the belief that you need to buy an entire Bitcoin, which may seem expensive, it’s possible to purchase fractions, known as Satoshis. Investing a small portion of your assets in Bitcoin could protect you from total loss while offering significant upside potential. Despite the market’s volatility, adopting a strategy of incremental investment can mitigate risks and enable a rational approach to entering the market.

5. Where and how can I buy Bitcoin?

To purchase Bitcoin, you must register and verify your identity with a service provider, a process designed to prevent money laundering and criminal activities. Many platforms offer Bitcoin purchasing and trading services. We recommend using Relai for its user-friendly interface. A step-by-step buying guide can provide further assistance.

6. What other cryptocurrencies are there?

There are thousands of alternative cryptocurrencies, or “Altcoins,” most of which were not created to solve specific problems or offer unique benefits but to capitalize on investor naivety. While a few projects aim to improve upon Bitcoin’s design, often at the expense of security, the vast majority of altcoins are either useless or fraudulent.

7. Should I also buy other cryptocurrencies?

While we do not provide investment advice, we recommend beginners focus on Bitcoin to gain an understanding of the market’s dynamics. Distinguishing between potentially valuable investments and baseless speculation can be challenging for those new to the technology and economics of cryptocurrencies.

Nyet Shitcoin

8. How do I store Bitcoin safely?

Safe storage of Bitcoin requires understanding cryptography, public and private keys, and how wallets function. While this may seem daunting, it is manageable with some research. Depending on where you purchase your Bitcoin, the storage method may vary. It’s crucial to secure your backup phrases (12 or 24 words) as they are essential for accessing your assets. For long-term storage, consider using a hardware wallet like the BitBox

02, which offers enhanced security and ease of use.

9. Do I have to pay tax on Bitcoin?

Yes, profits from trading Bitcoin and other cryptocurrencies are taxable if held for less than a year. To avoid tax issues, keep detailed records of your transactions. Tools like CoinTracking can simplify this process by tracking transactions and generating tax reports.

10. What else should I know?

Finally, some best practices include conducting your own research (DYOR), being cautious and skeptical, never investing more than you can afford to lose, and focusing on understanding Bitcoin’s technology, economics, and philosophy before diving into investment. Also, take precautions with your backups and make arrangements for your digital assets in case of unforeseen circumstances.