Inflation is a term that often buzzes through news headlines, leaving many to wonder about its real impact on daily life. This article aims to demystify inflation, explaining its origins, effects, and why traditional solutions seem to fall short, ultimately guiding you through the concept that Bitcoin might not just be a hedge against inflation but a solution to it.

What is Inflation?

In essence, inflation represents the rate at which the general level of prices for goods and services is rising, leading to a decrease in purchasing power. Imagine buying a loaf of bread for $1 last year, and now it costs $1.10; that’s inflation at work. Over time, this decrease in purchasing power affects everyone, making it harder for people to afford the same standard of living.

The Origins of Inflation

Inflation has been a part of economic cycles throughout history, with one of the earliest examples being the collapse of the Roman Empire, partly due to the devaluation of their currency. More modern examples include Zimbabwe’s hyperinflation in the late 2000s, where a 100 trillion Zimbabwean dollar note became necessary, and Venezuela’s ongoing economic crisis, demonstrating inflation’s devastating potential.

Inflation Is Eroding Our Purchasing Power

A Pivotal Moment: 1971

A significant turn in the inflation narrative occurred in 1971 when President Nixon took the United States off the gold standard, fundamentally changing the global financial system. This shift allowed for more flexible monetary policies but also introduced the possibility of unlimited money printing, laying the groundwork for future inflation spikes.

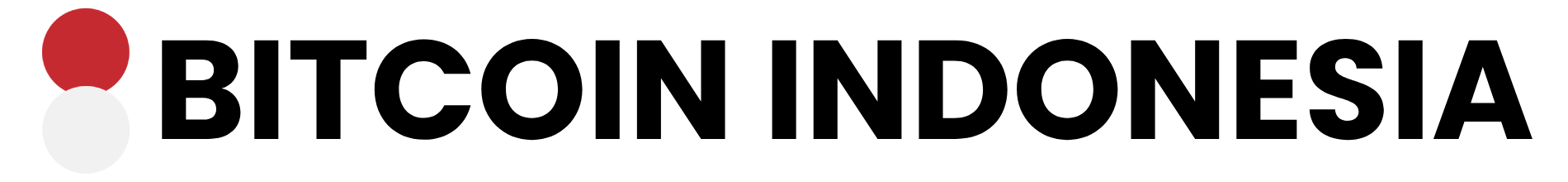

Inflation-Is-Transitory and Good For The Economy meme

The Inflation Monster

The Tuttle Twins series, particularly episode 6 titled “The Inflation Monster,” provides a kid-friendly explanation of how inflation works and its effects on savings and purchasing power, making the concept accessible to all ages.

Inflation’s Direct Impact on You

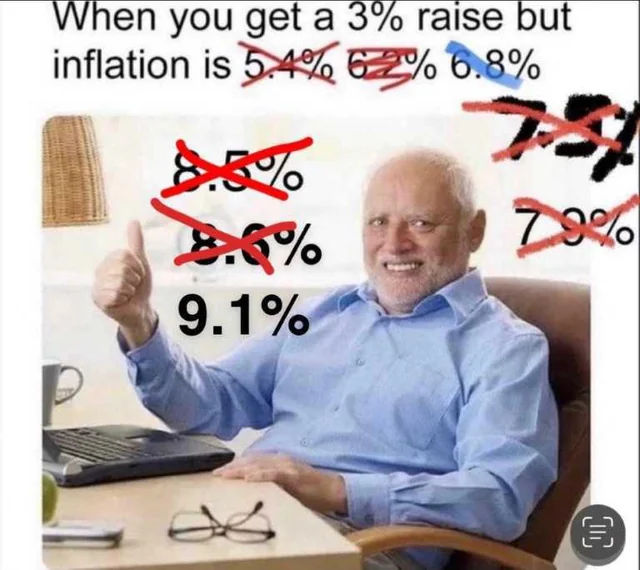

For the average person, inflation means your money buys less over time. Salaries may not increase at the same rate as inflation, effectively reducing your real income. This scenario places a strain on households, making it challenging to save or even maintain a stable lifestyle. Images below are taken from the book written by Bitcoin Indonesia.

Purchasing Power of Indonesian Rupiah IDR is collapsing over time against the US dollar

The Limitations of Fiat Money

The root issue with controlling inflation in a fiat currency system—where money’s value is not backed by a physical commodity—is its centralization and the ever-present incentive to print more money. This system is debt-based; as long as there is debt, there will be more money creation, inevitably leading to inflation.

Bitcoin: A Solution to Inflation?

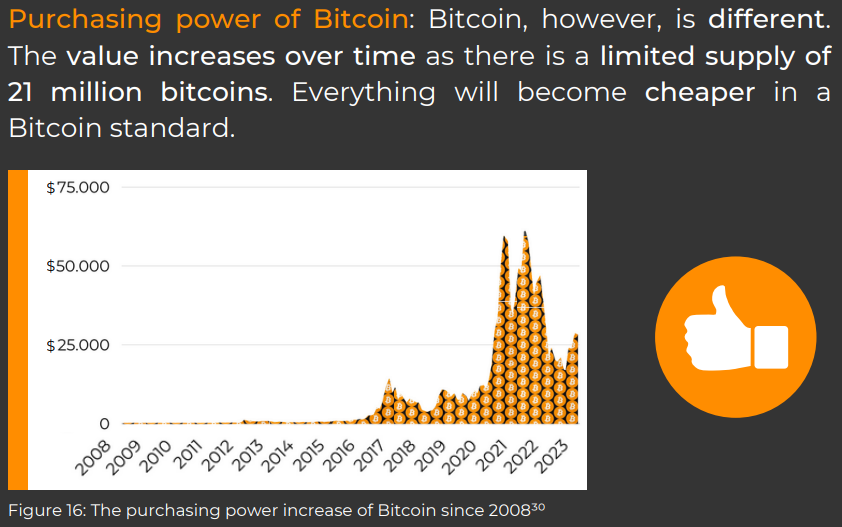

Bitcoin presents a decentralized alternative to fiat money, operating on a supply cap of 21 million coins, eliminating the possibility of unchecked money printing. Parker Lewis, in his piece “Bitcoin is Not a Hedge” argues that Bitcoin’s fixed supply and decentralization offer a permanent solution to the inflation problem, providing a system where value is not eroded by the creation of new money.

purchasing-power-of-Bitcoin-is-increasing-over-time

Conclusion: Navigating the Inflationary Landscape

Understanding inflation is crucial for managing your finances in an ever-changing economic environment. While traditional fiat currencies offer limited defenses against the erosion of purchasing power, Bitcoin emerges as a compelling alternative, promising a future where inflation can be effectively removed. As we navigate through these inflationary times, it becomes increasingly important to explore and understand alternatives that offer a safeguard against the diminishing value of money.